So, did we stick to the budget?

No. We spent £331.66 more than our budget.

If no, why not?

Two big out-lays.

£178 on gymnastics classes for my daughter - taking up to the end of the calendar year. Needs to be included within budget going forward.

£216.10 Mrs went on a spending spree in Next and brought clothes for the next 3 years for the kids. Very much a one-off.

Plus, Grocery shopping was also £100 over budget.

Did we earn more than we spent?

Yes. We earnt £23.26 more than we spent.

Any positives / milestones?

- It should always be a positive that we have earnt more than we spent. 3rd month in a row we have earnt more than spent.

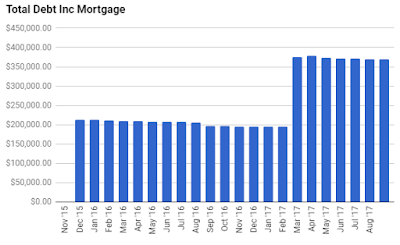

- Debt including mortgage dropped below £370k. Currently £369,663.56.

- Got paid a 77p dividend from Coca Cola. Almost all of my investments are in index funds. However, I had £60 several months ago in my XO account - it cost's £60 to close the account so instead I purchased shares in Coca Cola and a City of London Fund.

No idea what to do with this long-term... but I do like receiving dividends. Only the second time ever.

Lessons / thoughts?

Gymnastics is missing from my budget.

Other than the items called out in reasons why we missed the budget everything else seemed on track.

I use Betfair to do my Matched Betting. This normally has a decent 'float' of cash. It seems unfair to exclude this money from the overall savings so from next week will include the Betfair wallet value as Cash Savings. Today this is £346.

Effect on overall debt?

Gymnastics is missing from my budget.

Other than the items called out in reasons why we missed the budget everything else seemed on track.

I use Betfair to do my Matched Betting. This normally has a decent 'float' of cash. It seems unfair to exclude this money from the overall savings so from next week will include the Betfair wallet value as Cash Savings. Today this is £346.

Effect on overall debt?

Student loan remains paid off :)

House loan remains paid off :)

Wedding card balance is £1,574.77

0% Carpet loan balance is £1,881.83

Total Debt Exc Mortgage = £3,456.60

* Above graph. I have deleted the info for Jan and Mar 2017 as they were messed up due to large re-payment of debt. It made the rest of the months hard to judge by scale.

Wealth Accumulation

Summary:

| Asset |

Value

|

Increase

|

| Pension Value |

£19,249.60

| £252.81 |

| XO Shares Account |

£63.49

|

£2.60

|

| Company Sharesave. |

£900

|

£100

|

| Fidelity Global Index Tracker |

£714.70

|

£107.76

|

| Total |

£20,927.79

|

£463.17

|

*Above graph. Probably my favourite graph. That gap between debt and savings (excluding pensions and mortgages is down to £1,778.41 now. This is decreasing roughly £300~ per month.

~~~~~~~~~~~~~~~~~~~~~~~~

Net Worth

£151,264.23.

An increase of £1,143.11 since last month.

No comments:

Post a Comment