I thought Brexit was the 'big' thing that we'd live through for a while... well Covid-19 certainly tops that doesn't it.

Dividends are being cut left, right and centre. However, I am going to plough on in the hope that the companies I invest in remain solvent and return to earnings and dividends growth in a few short years.

Tomorrow I will invest the next £200 from my bonus 'dividend portfolio' cash. A new purchase will follow every 2 weeks until that money has used.

Focus remains on building the size of the portfolio, in terms of quantity of companies, until I have a minimum of 15 (currently 10 - although 1 of those is significantly smaller and purchased prior to all of this. So 9 in reality).

I've got 9 stocks on my watch list.

AHT / BRBY / CPG / DCC / MGGT / MNDI / PRU / RB. / SMIN

6 of these are ruled out at the moment as I own companies within their sectors already

AHT, CPG, DCC = same sector as BNZL

RB. = same sector as BWY

PRU = same sector as LGEN

BRBY = same sector as ULVR

Obviously, some of these have a higher degree of overlap than others. However, for simplicity sake, and whilst I have other options, I am putting them to one side.

That leaves MGGT, MNDI and SMIN

~~~~~~~~~~~~~~~~~~~~~

Meggit (MGGT). Aerospace and Defence sector, one where I hold no shares.

High performance engineering company supplying predominantly to aircrafts.

Obviously available (283p) at a massive discount to 52-week high (701p) with 196p the 52-low.

Market cap of £2.2bn means it's 98th on the FTSE100 rankings and a possible relegation looms.

Dividends

Potential yield at current price is 6%

Dividends paid since 2000 with 11 years of consecutive annual growth. Growing at over 4.9% per annum over the last 5 years.

Div Cover is a more than healthy 2.05

Financials:

I don't really know what I'm doing in this area. But lots of reading over the years has led me to focus on a couple of core things.

- Are Earnings Per Share (EPS) consistently growing? YOY EPS growth 5+ year

- Grown in 2 of the last 5 years. 👎

- Are they paying out too much on dividends? Payout Ratio <60%

- 56% 👍

- Is the ratio of share price to earnings sufficiently low enough? PE ratio <18

- 7.21 👍

- Is the Gross and Net Operating profit high enough? Gross 20%> Net 5%>

- 👍Gross average is above 40%, Net above 14%

- Debt levels? Current Ratio >1 & Debt:Equity <1

- 1.8 and 0.49 respectively 👍

Conclusion:

A solid potential, ticking every box other than EPS growth. Perhaps the yield on offer would make this a worthwhile risk.

~~~~~~~~~~~~~~~~~~~~~

Mondi (MNDI). In Forestry and Paper sector, where I currently have no shares. To be honest I wasn't aware this was a sector.

Manage forest and produce pulp, paper and plastic films.

Current price is 1,383p

52-high 1,861 and 52-low, 1,156

Market Cap of £6.71bn, 50th~ in the FTSE100

Dividends

Potential yield at current price is 5.4%

Dividend paid since 2008, 11 years of consecutive dividend growth. Growing at over 13% per annum.

Div Cover is a more than healthy 2.06

Financials:

I don't really know what I'm doing in this area. But lots of reading over the years has led me to focus on a couple of core things.

- Are Earnings Per Share (EPS) consistently growing? YOY EPS growth 5+ year

- Grown in 4 of the last 5 years. 👍

- Are they paying out too much on dividends? Payout Ratio <60%

- 40.8% 👍

- Is the ratio of share price to earnings sufficiently low enough? PE ratio <18

- 8.78 👍

- Is the Gross and Net Operating profit high enough? Gross 20%> Net 5%>

- 👍Gross average is above 43%, Net above 14%

- Debt levels? Current Ratio >1 & Debt:Equity <1

- 1.05 and 0.37 respectively 👍

Conclusion:

Literally, MNDI tick every box on my screen and coupled with a 5.4% yield and a history of really impressing dividend growth, going to take something to beat this.

~~~~~~~~~~~~~~~~~~~~~~

Smiths (SMIN). General Industrials sector. I do not own.

Tech firm for Medical tech, Aerospace, Energy, General & Security.

Current price is 1,126. 52-high is 1778 and 52-Low is 790.

Market Cap of £4.86bn putting them 80th~ in the FTSE100

Dividends

Potential yield at current price is 3.76%

Dividend paid since 2000, 10 years of consecutive dividend growth. Growing at 2.6% per annum.

Div Cover is a 1.49

Financials:

I don't really know what I'm doing in this area. But lots of reading over the years has led me to focus on a couple of core things.

- Are Earnings Per Share (EPS) consistently growing? YOY EPS growth 5+ year

- Grown in 3 of the last 5 years. 👍

- Are they paying out too much on dividends? Payout Ratio <60%

- 55% 👍

- Is the ratio of share price to earnings sufficiently low enough? PE ratio <18

- 16.31 👍

- Is the Gross and Net Operating profit high enough? Gross 20%> Net 5%>

- 👍Gross average is above 45%, Net above 15%

- Debt levels? Current Ratio >1 & Debt:Equity <1

- 2.94 and 0.64 respectively 👍

Conclusion:

I like SMIN. The EPS over the last five years, whilst grown 3 out of the 5, does appear to be trending down which is a cause for concern. Low dividend growth over the previous 5 years too coupled with a lower starting yield.

~~~~~~~~~~~~~~~~~~~~~~~~

Decision

Tomorrow morning I will purchase MNDI as my 10th main company for my dividend portfolio.

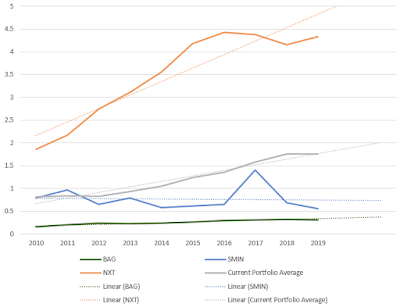

This graph of historical EPS growth across the 3 companies particularly impressed me.

*Update*

- 15 shares were purchased in MNDI for a total price of £208.41.

- Average cost per share of £13.89.

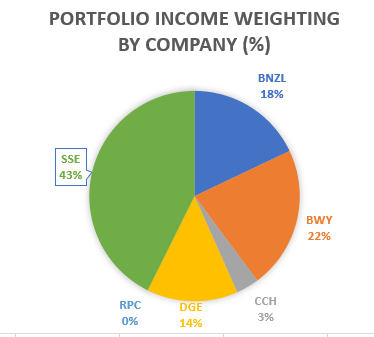

- MNDI now make up 10% of my portfolio by holding value

- And add £10.95 in potential annual dividends, taking the portfolio annual expected dividend over £100 to £102.95