So, did we stick to the budget?

No. We overspent massively due to receiving bonus and paying off debt.

However, our actual spend vs actual income was positive.

Any positives?

Paid off house loan.

Lessons / thoughts?

It's been a while since I updated the monthly spending. It appears that with my work expenses being included, matched betting moving money all over the place and with the recent bonus it's hard to keep an accurate track of the actual spending reality and budgets.

Could do with separating out my expenses and putting a lump aside for matched betting and not moving in and out of main accounts.

Effect on overall finances?

It's been a while since I updated the monthly spending. It appears that with my work expenses being included, matched betting moving money all over the place and with the recent bonus it's hard to keep an accurate track of the actual spending reality and budgets.

Could do with separating out my expenses and putting a lump aside for matched betting and not moving in and out of main accounts.

Effect on overall finances?

S Student loan – Does not exist anymore :)

· House loan – Does not exist anymore :)

· Credit Card - Down to £1,845.

Carpet loan - stands at £2,278.

Carpet loan - stands at £2,278.

Total Debt = £4,123

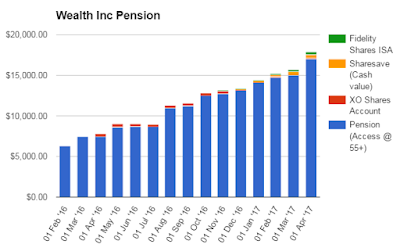

Wealth Accumulation

Summary:

| Asset |

Value

|

Increase

|

| Pension Value |

£17,033.39

| |

| XO Shares Account |

£52.89

| |

| Company Sharesave. |

£500

| |

| Fidelity Global Index Tracker |

£304.14

| |

| Total |

£17,890.42

|

Wealth excluding pension rising steadily now that I've set up direct debits into the Shares ISA and for the company Sharesave.

Not too far off savings (exc pension) overtaking my debts (exc mortgage).