Tomorrow we move into a new house.

It's been about 5 months since we had our offer accepted and has been a bit of an up-and-down path, and been highly stressful!

All payments required for the sale of our property and the purchase of the new one (still in the same village) go via our solicitors in one neat payment, which is a smooth process.

I've just settled our bill - at just over £1,700 in cash paid.

All available cash is now in one bank account and it seems a clean and sensible time to take stock of what money we have and where it's going to go.

Next month we'll have updated mortgage, energy, water, council tax bills and so I'm suspecting we're going to have a pretty hard time off it until things settle down and we're able to build a bit of a buffer.

Our current buffer is £500.

I'm going to use a good portion of this to act as my float for 'Matched Betting' link and increase money via that. Although I'm hoping to be able to use that as investment money rather than anything else!

I was £28k in debt excluding mortgage. I have used this blog to track my progress of paying that down and now I am using it support my dividend investing strategy for wealth creation.

Thursday 26 January 2017

#44 Matched Betting

About 3 months ago I came across a thing called 'Matched Betting'.

It's effectively an organised way to may money out of bookmakers by only using their promotions.

It's sold as "earn £1,500 a month tax free"... and so I suspect is ignored by a lot of people.

The reality...

Working in the industry I find it very easy to understand and actually quite enjoyable. Although it can be time-consuming.

Talking to friends I can see that the idea can be quite hard to grasp and not very fun.

How have I got on...

I started in October 2016. Had Nov, Dec and Jan as full months where I spent significant time on it.

In that period I have made a profit of £1,178.55.

Quite frankly it's brilliant.

At first their are sign-up offers and the money is easy.

Then once these have been completed it gets far more complicated. I estimate about £1000 can be made from the sign-ups alone.

Next steps...

My wife is going to go through the sign ups, with my help and I will track the earnings in my monthly update, which I will now include all earnings as well as spending.

To continue to earn money post the sign-up deals I believe I'll need about £1,500 as my float.

Everything else is going to go to investments. On top of this I'm going to start a £50 per month standing order into a new, separate global index tracker fund.

If anyone else is interested in this here's an affiliate link to the company I use 'Odds Monkey': https://www.oddsmonkey.com/affiliates/affiliate.php?id=55068

It's effectively an organised way to may money out of bookmakers by only using their promotions.

It's sold as "earn £1,500 a month tax free"... and so I suspect is ignored by a lot of people.

The reality...

Working in the industry I find it very easy to understand and actually quite enjoyable. Although it can be time-consuming.

Talking to friends I can see that the idea can be quite hard to grasp and not very fun.

How have I got on...

I started in October 2016. Had Nov, Dec and Jan as full months where I spent significant time on it.

In that period I have made a profit of £1,178.55.

Quite frankly it's brilliant.

At first their are sign-up offers and the money is easy.

Then once these have been completed it gets far more complicated. I estimate about £1000 can be made from the sign-ups alone.

Next steps...

My wife is going to go through the sign ups, with my help and I will track the earnings in my monthly update, which I will now include all earnings as well as spending.

To continue to earn money post the sign-up deals I believe I'll need about £1,500 as my float.

Everything else is going to go to investments. On top of this I'm going to start a £50 per month standing order into a new, separate global index tracker fund.

If anyone else is interested in this here's an affiliate link to the company I use 'Odds Monkey': https://www.oddsmonkey.com/affiliates/affiliate.php?id=55068

Tuesday 3 January 2017

#43 December Summary

So, did we stick to the budget?

Christmas. We spent roughly £500 on eating out as a family and £200 on travelling to see family.

Any positives?

Spending is over now.

Debt has dropped below £8k.

Lessons / thoughts?

Should budget for this for next year.

Expectations for next month?

Should budget for this for next year.

Expectations for next month?

Try and have a really lean month. However, potentially we'll be moving into the new house so might come up with unexpected costs then.

Effect on overall finances?

S Student loan – Does not exist anymore :)

· House loan – £298 was paid off direct debit. Total remaining now is £5,653

· Credit Card - £45.46 was paid off. Total remaining now is £1,975.37

Total Debt = £7,628.37

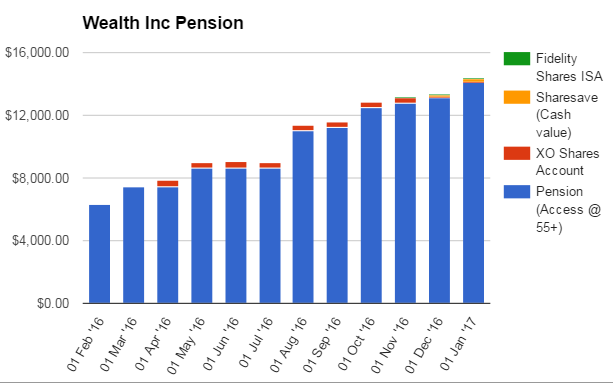

Wealth Accumulation

Summary:

Problem setting up the monthly share save scheme has led to no further payments being made.

I sold my personal PPBF shares as now I am in the work sharesave scheme. £60 remains as cash in the account to prevent closure fee of £60.

I sold my personal PPBF shares as now I am in the work sharesave scheme. £60 remains as cash in the account to prevent closure fee of £60.

#42 2017 Aims

Review of 2016 aims.

1) I will pay off all of the remaining £7k credit card loan from the wedding. Done.

2) I will put up a fence in our front driveway. Done.

3) I'm going to start investing for the future. Done.

4) rather contrary to 1 and 3, I will take my family on a holiday abroad in 2016. Done.

I started 2016 £25,202 in debt. I ended it only £7,628 in debt.

Current financial status:

Debt: £7,628

Wealth including Pension: £14,391

Wealth excluding Pension: £310

We have very little in rainy day savings. Very little invested for growth. And no will.

We are 90% of the way through a house move which will tie us to an expensive mortgage for the next 5 years.

Aims for 2017:

Financial:

I started 2016 £25,202 in debt. I ended it only £7,628 in debt.

Current financial status:

Debt: £7,628

Wealth including Pension: £14,391

Wealth excluding Pension: £310

We have very little in rainy day savings. Very little invested for growth. And no will.

We are 90% of the way through a house move which will tie us to an expensive mortgage for the next 5 years.

Aims for 2017:

Financial:

- Pay off the remaining £7,628 of debt.

- Increase wealth excluding Pension to £3000

- Overpay on the mortgage by £600. Equivalent to £50 per month.

To do:

- Get a will for the family.

- Complete one item from my bucket list

Physical:

- Get weight to below 14st

- Run 13.1k without stopping (half marathon distance)

Subscribe to:

Posts (Atom)