So, did we stick to the budget?

No. We spent £365.72 more than budgeted. Largely this was due to paying for our France holiday. Coming around soon!! However, this was paid for with Matched Betting savings.

Did we earn more than we spent?

Yes. £461.56 more than we spent. Largely due to a mistake by HMRC (again!) which meant I paid £450 less in taxes this month than I should have done.

Any positives?

Income greater than amount spent for the second month in a row.

Total variable spending was below budget for only the second time since June 2015. (Holiday was included within Fixed).

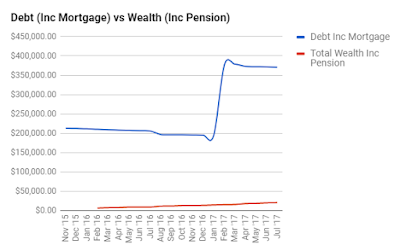

Total wealth including Pension exceeded £20,000 for the first time ever.

Net worth exceeded £150,000 for the first time ever.

Lessons / thoughts?

Don't really have any major goals currently.

The £450 in additional income due to lower tax will have to be re-paid in January 2019. So I will put this to one side.

I also have a tax bill of £1000 due in January 2018 which I will need to save up for now to ensure I can comfortably pay.

I should start saving for next summers family holiday.

Effect on overall debt?

Don't really have any major goals currently.

The £450 in additional income due to lower tax will have to be re-paid in January 2019. So I will put this to one side.

I also have a tax bill of £1000 due in January 2018 which I will need to save up for now to ensure I can comfortably pay.

I should start saving for next summers family holiday.

Effect on overall debt?

Student loan remains paid off :)

House loan remains paid off :)

Wedding card balance is £1,558.33

0% Carpet loan balance is £1,980.88

Total Debt Exc Mortgage = £3,539.21

No comments:

Post a Comment