2020 was pretty crazy on a personal note;- I completed the first of three stages (years) on a Henley MBA course

- I have been leading the biggest project/programme of my career at work

- We cashed in all shares and stockpiled cash as we targeted purchasing a holiday-let house in Cornwall

- I became co-Chairman of my local village youth football club

I have learnt a lot, including realizing I have an appetite to learn much more about the world of business, and have been very busy at work. Our attempt to purchase a house for the purpose of letting it out as a holiday-let fell through when someone came in last minute and offered more on the one property we found that ticked all of our - quite-specific- boxes. The co-Chairman role came out of nowhere in December, but youth football is something I have a lot of passion for and the club has struggled with a lack of leadership. So I am hoping I can be an asset and improve what is a pretty poorly run club at present and also use it to try out areas of business I have little experience in, eg strategy setting.

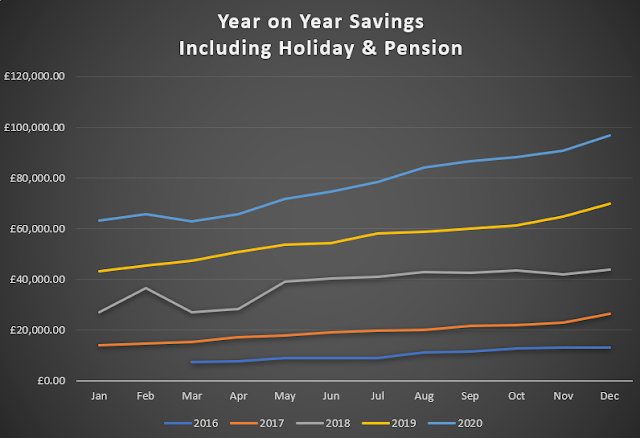

Financially it has been a good year. Having paid off all loans exc mortgage in previous years we were in a position to save the two windfalls (Bonus and Sharesave maturity) that came our way in 2020.

We started Jan 2021 with just over £34k in equities, cash or Sharesave investments, which is a whopping great more than the £20k we ended 2019 with.

This growth has predominantly been realised from the bonus and Sharesave maturity rather than saving more and spending less. Our variable spending has had a very up and down year, it dropped considerably low during the first national lockdown, but then bounced back to higher levels with October holiday and some pretty extravagant Christmas present purchasing.

Expectations for 2021

- I expect to carry on an complete the second stage (year two) of my MBA. Continuing to invest time and effort to maximise the amount I learn is the primary aim here.

- I expect my 'big' project to complete around Q3 at work. This project has taught me a lot, given me the opportunity to try new things and also provided me the opportunity to build relationships with senior leaders. The big question for me to get clear for myself is.. what next. What do I want to do and why when this project completes and over the coming years.

- We are trying for a baby, which will be our 4th and last, and thus have put the previous plans for a holiday let on hold.

One of the reasons for picking up the proverbial pen and paper to write this post is because I find it helps me distill my thoughts for big decisions in our personal and financial life.

Having a 4th baby is going to introduce a number of changes to our current lifestyle which will be expensive to resolve.

Firstly, our car isn't adequately 'safe' to have 6 people in so that will need to be upgraded to a larger car. My early research points to something like a Volvo XC90. But this will be circa £30k being spent on a car that is already 3 or 4 years old. This type of financial spend on a car, which is a depreciating asset, really doesn't sit well with me at all.

Secondly, our house is a bedroom short if/when the family increases to 6. We can accept a sharing of rooms on a temporary basis but not medium/long term. Moving out of the location isn't something we wish to do. Moving to a bigger house is almost certainly too expensive. Luckily we bought this house as it has potential to extend, so we will need to look at this.

As discussed early in this post, we have cashed out all shares that I had previously purchased. So now we have a big pile of cash but no current investments other than pension and Sharesave, and no monthly investing for us or the children. Given the financial uncertainty I expect to keep it like this so that we can move quickly and adapt if needed, but I don't like it.

So in 2021 I just need too....

Successfully deliver the biggest project of my career whilst forming a clear vision on my aspirations and targets...

...Whilst completing a challenging MBA and maximising my learning potential through this...

...Whilst having another baby to 'complete' our family...

...Hopefully without spending every penny, that we have saved and scrimped over, on a flashy new car

...And come to a conclusion on how we should increase the living space when this little on does come along.