I found I quickly lost motivation to carry on afterwards because a) I needed a break and b) I'd made so much so quickly that the potential returns for the offers available just didn't excite me.

This has carried on for the months since, where I've only really done a handful of promotions and mainly just the Bet365 50, 50 deals.

~~~~~~~~~~~

I listen to a lot of music, audio podcasts and watch Netflix when travelling.

For a good couple of years now I've wanted some good headphones and had been toying with the idea of buying some this christmas again.. but have never made the jump as I just can't stand by paying hundreds of pounds for them, for something which I dont really NEED.

~~~~~~~~~~~

So... coupling my lack of motivation for Matched Betting with my desire to have some good headphones but not spending my hard earned salary on them... I'm now working through MB again with a specific aim of earning enough money prior to Christmas to treat myself.

~~~~~~~~~~~

How am I getting on?

I've set myself a very healthy budget target of £350 for the headphones - a lovely pair of wireless, noise cancelling pair will do very nicely thanks.

I started on 23-Nov. Exactly one week ago.

Unsurprisingly, my motivation is back :)

In that week I've taken part in 13 offers, and have made a profit of £161.

Now this was helped largely by another random B365 bet 50 get 50 on the Liverpool game, but I have also started picking up new sign offers and some of the spins deals.

With this good start I'm confident I'll reach £350 pre-christmas and will be enjoying my new headphones.

UPDATE 10-JAN:

I certainly found my motivation is back for matched betting. Since I re-started this on the 23-Nov, 48 days ago I have...

With this additional income I've been able to pay off the credit card and have -today - earnt enough to also by the long-awaited headphones.

However, I've found that having the carrot of the heaphone purchase has been a massive motivator.

So I've given myself 2 more challenges.

1) I need to go out running for 15 straight days - no more planning and rest days, I dont run enough as it is. After these 15 days I will allow myself to buy the headphones.

2) And I will carry that on for a further 15 days - at which point I will allow myself to open the box and use them :)

Next - via matched betting - I am going to save up £100 each for two friends of mine.

Other ideas I have are

UPDATE 10-JAN:

I certainly found my motivation is back for matched betting. Since I re-started this on the 23-Nov, 48 days ago I have...

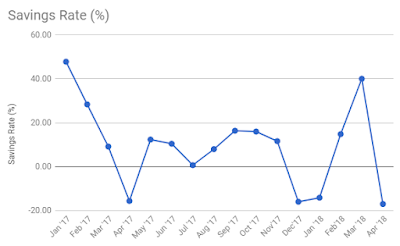

- Partaken in 251 offers

- Earnt £1,218.42

- ..at an average of £4.85 per offer

- And only had 7 days where I have not partook in an offer

With this additional income I've been able to pay off the credit card and have -today - earnt enough to also by the long-awaited headphones.

However, I've found that having the carrot of the heaphone purchase has been a massive motivator.

So I've given myself 2 more challenges.

1) I need to go out running for 15 straight days - no more planning and rest days, I dont run enough as it is. After these 15 days I will allow myself to buy the headphones.

2) And I will carry that on for a further 15 days - at which point I will allow myself to open the box and use them :)

Next - via matched betting - I am going to save up £100 each for two friends of mine.

Other ideas I have are

- funding to increase my dividend portfolio - currently at 2 company's and with a expected annual income of £22 lol

- pay for a 12 month subscription to

- Premium Spotify

- A Gin club :)

- A craft beer club

- Pay off some of the car loan

- Increase our cash savings (tried this in the past and lost motivation)

- Begin saving again for a potential BTL adventure... a very long road... but one which I have kept coming back to the thought off since I was about 10 years old