After noticing some odd maths in the summary I received for my tax year I phoned HMRC back this morning to question further.

After 20 minutes of explaining my concerns I was told that in fact I didn't owe any money and that in fact HMRC owe me £700 and this normally takes 3 weeks to receive.

How can it change so swiftly and to such an extent with - to my knowledge - no or limited change!

It's very good news that the £4,700 is no longer being requested.

I can't relax and use the £700 when received though as I have little to no confidence they won't re-visit their calculation and come up with another different figure!

Still, if nothing else it buys us time to save up money... this really does just re-instate how important it is for us to create and grow an emergency savings fund.

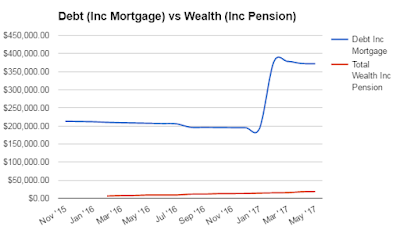

I was £28k in debt excluding mortgage. I have used this blog to track my progress of paying that down and now I am using it support my dividend investing strategy for wealth creation.

Monday, 15 May 2017

Wednesday, 10 May 2017

#50 Bloody Taxman

My wife does not work. We are fortunate enough to be able to live off my salary, although we make sacrifices to enable this - ie we've had 1 foreign holiday in 6 years, barely eat out etc. We're very happy with our situation.

However, my wife's time now not working will mean she does not get a state pension. There are a minimum number of years needed to be entitled to this.

Whilst claiming child benefit, which she is entitled too, this adds to her NI contributions and therefore towards the number of years that count towards her state pension.

However, as I earn over the £50k threshold and we are married I have to pay back what she has received.

*Don't get me started on why this is based on the highest earners income rather than household - it's a family benefit for gods sake. A couple earning £100k between them, £50k each, will not repay a penny.

Anyway, first world, or 40% earner problems I guess, we are lucky to even have that annoyance.

So every year I have to submit a self assessment due to this.

Anyway, that's the context.

Last year we got hit with an unexpected £1700 tax bill because we had underpaid in tax 2 financial/3 calendar years previously, but this has not been caught up in the system yet. It was clear we had upon review but still hard to swallow.

This financial year I have been paying back the child benefit from last year as well as the current year, so double tax. It's been a big hit.

However, upon completing my self assessment the computer tells me I owe £4700!!!!!! for this financial year.

I've spoken to HMRC and they first believed it was due to my student loan, which I repaid early in the FY but the numbers seem to stack up.

Then they thought it was because the incorrectly changed my tax code for one month, which gave me a take home of an extra £1,100 one month. But that still leaves £3,600 un-accounted for.

I was left with, well you must have just under-paid! I have paid £25,000 in tax this year, have been on a tax code of only 319 all year and have not changed my circumstances. I cannot have just under-paid by £300 a month for the whole year and no-one, myself included, notice it.,

Anyway, I now have to wait until early June when they will have reviewed my file apparently.

Fingers crossed I'm not stuffed with this, it'll be a crusher.

Anyway rant over.

Thanks

Brian

However, my wife's time now not working will mean she does not get a state pension. There are a minimum number of years needed to be entitled to this.

Whilst claiming child benefit, which she is entitled too, this adds to her NI contributions and therefore towards the number of years that count towards her state pension.

However, as I earn over the £50k threshold and we are married I have to pay back what she has received.

*Don't get me started on why this is based on the highest earners income rather than household - it's a family benefit for gods sake. A couple earning £100k between them, £50k each, will not repay a penny.

Anyway, first world, or 40% earner problems I guess, we are lucky to even have that annoyance.

So every year I have to submit a self assessment due to this.

Anyway, that's the context.

Last year we got hit with an unexpected £1700 tax bill because we had underpaid in tax 2 financial/3 calendar years previously, but this has not been caught up in the system yet. It was clear we had upon review but still hard to swallow.

This financial year I have been paying back the child benefit from last year as well as the current year, so double tax. It's been a big hit.

However, upon completing my self assessment the computer tells me I owe £4700!!!!!! for this financial year.

I've spoken to HMRC and they first believed it was due to my student loan, which I repaid early in the FY but the numbers seem to stack up.

Then they thought it was because the incorrectly changed my tax code for one month, which gave me a take home of an extra £1,100 one month. But that still leaves £3,600 un-accounted for.

I was left with, well you must have just under-paid! I have paid £25,000 in tax this year, have been on a tax code of only 319 all year and have not changed my circumstances. I cannot have just under-paid by £300 a month for the whole year and no-one, myself included, notice it.,

Anyway, I now have to wait until early June when they will have reviewed my file apparently.

Fingers crossed I'm not stuffed with this, it'll be a crusher.

Anyway rant over.

Thanks

Brian

#49 April Summary

So, did we stick to the budget?

Nope. £742.08 over. Excluding work expenses - which will be repaid.

Did we earn more than we spent?

Nope. Spent £300.04 more than we earnt. Excluding expenses.

Any positives?

Total debt excluding mortgage dropped below £4k for the first time. Which means in 18 months we've paid off nearly £22k of debt.

Also, not particularly positive, but explanations.

Paid final tax repayment of £472. Excluding for this one-off we would have earnt more than we spent.

We also had to pay £200 for childcare. However, this is a deposit which we'll get back in 18 months.

On top of this, this is always a busy time of the year for us. With all four of our birthdays falling between February and May as well as our wedding anniversary.

Lessons / thoughts?

It's been hard to get a clear picture with my work expenses sandwiched in the middle. I've now set up a separate credit card to deal with this and make it cleaner going forward.

We still have very little 'contingency cash' for when unexpected issues crop up. This is our priority now.

Almost every month we've over spent. Often because each month has a big one-off unexpected payment in it. Perhaps it's due to poor planning on my part or poor budgeting. Will change nothing for now but will consider this over the coming months and perhaps do some digging into previous months to try and see if there is a better way to capture this.

Effect on overall debt?

It's been hard to get a clear picture with my work expenses sandwiched in the middle. I've now set up a separate credit card to deal with this and make it cleaner going forward.

We still have very little 'contingency cash' for when unexpected issues crop up. This is our priority now.

Almost every month we've over spent. Often because each month has a big one-off unexpected payment in it. Perhaps it's due to poor planning on my part or poor budgeting. Will change nothing for now but will consider this over the coming months and perhaps do some digging into previous months to try and see if there is a better way to capture this.

Effect on overall debt?

Student loan remains paid off :)

House loan remains paid off :)

Wedding card balance stands @ £1,803.52.

0% Carpet loan balance is £2,178.98.

Total Debt Exc Mortgage = £3,982.50

*this isn't that much of a useful graph anymore as it includes expenses and the large spike in Mar'17 was paying off debt from our bonus, so it's a positive really not a negative. However, I've not got a better graph yet to illustrate our spending. One to think on.

*This surprises me. What I realised is that we were paying off credit card from overspending in recent months so it's all a bit out of kilter. I need to work hard to align everything so that in circumstances like the above months when we earn more than spend - that we actually have something left over to save.

*not long to go now.

Wealth Accumulation

Summary:

| Asset |

Value

|

Increase

|

| Pension Value |

£17,539.21

| £505.82 |

| XO Shares Account |

£58.10

|

£5.21

|

| Company Sharesave. |

£600

|

£100

|

| Fidelity Global Index Tracker |

£398.46

|

£94.32

|

| Total |

£18,595.77

|

£705.35

|

Wealth excluding pension rising steadily now that I've set up direct debits into the Shares ISA and for the company Sharesave.

*this shows how little % and in value terms we have as available cash saved. However, is nice to see the pot increasing even if it cant be accessed for 25 years!

*The graph I pay most attention too I think. Before I was 'paying myself first' through direct debit this wasn't really changing month on month. Now we're seeing incremental gains each month and this month crossed the £1k barrier. Each milestone matters!

~~~~~~~~~~~~~~~~~~~~~~~~

Net Worth

Savings Assets = £18,595.77

Debt (exc mortgage) = £3,982.50

House Value = £500,000

Mortgage = £367,973.88

Net worth = £146,639.39

*Absolutely miles off!

*my second most looked at graph. Only a couple of grand in it now. Will be a big fat smile on my face when these lines intersect.

Subscribe to:

Posts (Atom)