ABF - BATS - BNZL - BWY - CCH - DGE - JMAT - LGEN - MNDI - NXT - SSE - ULVR

After some shortlist reviewing today I am looking at Moneysupermarket.com (MONY).

Well known comparison and insurance site. Within a sector (Media) that I currently do not have exposure too.

With a current share price of 315p, currently sitting squarely in the middle of the 52 week high (419) and the 52 week low (210).

Market Cap of £1.7bn puts it in the top quarter of the FTSE250.

Dividends

Current potential yield is 3.72%

Continuous dividend increases for the last 10 years. Averaging 8% yoy growth over the last five years.

Div cover of 1.55 currently.

Financials

- Are Earnings Per Share (EPS) consistently growing? YOY EPS growth 5+ year

- Yes they've grown YOY for the last ten years. 👍

- Are they paying out too much on dividends? Payout Ratio <60%

- The average payout ratio for the last 5 years is 69%. This is trending down though.

- Is the ratio of share price to earnings sufficiently low enough? PE ratio <18

- 16.81 👍

- Is the Gross and Net Operating profit high enough? Gross 20%> Net 5%>

- 👍Gross average is above 70%, Net above 30%

- Debt levels? Current Ratio >1 & Debt:Equity <1

- 1.32 and 0.15 respectively 👍

What I've been looking for is a company that is consistently growing YOY and providing a good return via dividends. MONY tick all of those boxes.

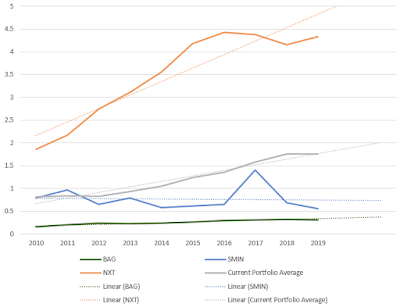

MONY EPS over the last 10 years vs the average of my portfolio...

So far I am convinced. The obvious concern is has the growth already happened.

The last check is vs the sector because 'Media' encompasses quite a few other candidates. From the FTSE100 we have

AUTO - too low yield for further analysis

INF - earnings performance isn't as strong

ITV - earnings performance isn't as strong

PSON - earnings performance isn't as strong

REL - too low yield for further analysis

RMV - I would really like to be invested in but the current yield is too low for my strategy ~1.3%

WPP - potentially but 10% yield raises flag

On that basis I am going to go with my instinct and add £200~ of MONY to my dividend portfolio, to take me up to 13 companies....

70 MONY shares purchased for £228.61 an average of £3.27 per share.

This equates to an expected yield per share of 3.59%

This increases the total forecast annual dividend of my portfolio to £90.17

MONY now makes up 9% of my portfolio weighted by holding value