In parallel, and mainly because I find it fun and therefore motivating I will continue investing additional funds into my Dividend producing portfolio.

The portfolio currently consists of 11 companies from the FTSE 350.

ABF - BATS - BNZL - BWY - CCH - DGE - JMAT - LGEN - MNDI - SSE - ULVR

I currently have a shortlist of 14 potential companies to add. I am aiming for a minimum of 15 companies within the portfolio before I consider increasing my investments in any of them.

The shortlist nominees are:

BAG - BRBY - CPG - CRDA - CWK - DCC - DPLM - HLMA - NXT - PRU - RB. - RMV - SMIN - SPX

However, based on current prices 6 are excluded because the yield is below 2.5%.

Excluded (6): CRDA - CWK - DPLM - HLMA - RMV - SPX

Remaining(8): BAG - BRBY - CPG - DCC - NXT - PRU - RB. - SMIN

Given I still have a relatively small portfolio I am also excluding companies which are within sectors where I currently own another company. I expect that in the future some of these may well be considered but for now they will be removed.

Excluded (4): CPG - DCC - PRU - RB.

Remaining (4): BAG - BRBY - NXT - SMIN

~~~~~~~~~~~~~~~~~~~~~~~

I reviewed SMIN in my previous #109 post and concluded that they were a possible but that the EPS lacked growth which was a cause for concern.

Let's see how BAG - BRBY and NXT weigh up.

Info:

BAG - the makers and providers of Scotlands famous Irn-Bru. £570m FTSE250

BRBY - luxury, fashion designer, manufacturer and retailer. £5.8bn Market cap. FTSE100

NXT - clothing retailer. Market Cap of £6.3bn. FTSE100 incumbent.

Dividends:

BAG - yield 3.3%, have 17 years of increasing dividends and a div cover of 1.92.

BRBY - yield 3.35, have 10 years of increasing dividends and a div cover of 1.95.

NXT - yield 3.55, have 1 year of increasing dividends and a div cover of 2.68. They were held previously but had many specials delcared which makes them slightly harder to compare.

Financials:

All three have either 3 (BRBY) or 4 (BAG & NXT) years EPS growth out of the last 5.

NXT has the lowest Payout Ratio (35%), followed by BAG (45%) and BRBY (55%)

All three have strong Operating margins.

NXT PE Ratio (9.17) is almost half that of BRBY (15.02) and BAG (16.08)

re: Debt, NXT are the only one with a warning light, their Debt:Equity is 1.63 where I am usually looking for <1.

Conclusion:

I've just noticed that I missed that BRBY operate in the Personal Goods sector and thus I should really remove them... they looked a good option, so one for the future.

That leaves BAG, NXT and SMIN.

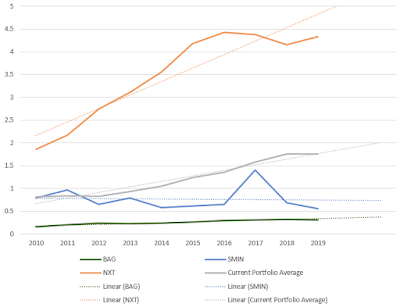

Given my concerns about SMIN EPS growth I mapped the previous 10 years for each potential and added the average of the 11 companies within my portfolio already.

It re-enforces that I will stay away from SMIN for the time being.

On this extended horizon it also paints NXT in a very positive light. If I was to use a 5 year horizon it would not look as strong growth.

I will however, on this time, side with NXT as my portfolio addition. They are a strong, consistent dividend payer, tick almost all of my screen requirements and on-top of that are a brand that I know and like very much - as does the wife.

Purchase Details

- 5 NXT shares were purchased for a cost price including fees of £243.48, ave cost per share of £48.70.

- NXT now form 10% of my portfolio by value.

- This adds an expected £8.25 in expected annual income, taking the total forecast annual income to £86.61. This has dropped recently due to the dividend cuts to BNZL, BWY and MNDI.

No comments:

Post a Comment