Mar '20

| |

Gross Income

|

£21,960.67

|

Total Tax and NI

|

£8,271.00

|

Total Variable Spending

|

£2,360.85

|

Total Fixed Spending

|

£1,587.64

|

Total Short Debt Repayment

|

£0.00

|

Net Income pre Fixed Savings

|

£9,741.18

|

Savings Rate (%) pre Fixed Savings

|

44%

|

Fixed Savings / Investments

|

£1,102

|

Net Monthly Cash

|

£8,640

|

Cash Savings Rate (%) Post Fixed Savings

|

39%

|

Commentary:

Bonus month.

I've spoken about what we will do with the excess cash previously, so won't dwell on that. But I will take another second to appreciate a) the income and b) the fact that we are short-term debt free and thus we can invest in wealth building rather than seeing this money go straight out.

Still £8,271 on tax is steep! I once listened to a podcast where a 'taxman' was explaining a hypothesis that if we all looked at tax as charity donations then it would give us a positive feeling upon reflection rather than a negative. I am therefore choosing to think of all the good work this tax will do, and think of it as a charitable donation to our society.

Obviously because of the bonus our savings rate, both pre and post our monthly fixed investments, was significantly higher than previously.

Variable spending was actually our lowest for six months. The second - and final for the year - month without council tax meant that our fixed spending was slightly lower than average too.

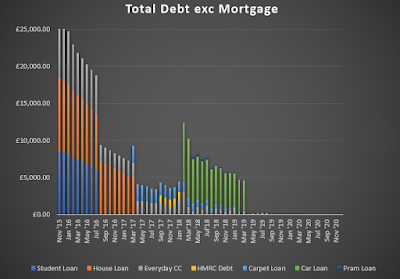

The result of not having to pay back any short-term loan as we have done in previous years is shown well in this graph... in 2017, 2018 and 2019 we made significant payments and in 2020 we didn't

March Wealth Update

- £351.62 paid into workplace pension

- £100 paid into SIPP

- £500 paid into workplace sharesaves (current Share Price £72.88)

- £100 into 2021 maturity (£100 for holiday)

- Option Price £57.87

- £200 into 2022 maturity (£100 for holiday, £100 for savings)

- Option Price £54.68

- £200 into 2023 maturity (£100 for holiday, £100 for savings)

- Option Price £59.56

- £150 paid into kids JISAs for the first time - global index funds

Bonus money

- £5k added to emergency cash pile

- £1,400 into my Dividend portfolio - not all of this has been invested yet

- £1,200 into my Global Index ISA - not all of this has been invested yet

I also found out I have been awarded some additional shares as part of a retain and incentive plan. This results in receiving, as long as I remain at the company;

- 76 shares in October 2021

- 76 shares in October 2022

These seem like a long way off, and a lot can happen in between then, both personally, my role and the share price. So I'm going to forget about these now until closer to the date. It is very rewarding to have been provided with my first incentive shares though.

Milestones

- Short-term debt free for 8 months

- Equities investments (outside of pension) now above £4k

- Emergency cash amount is now £10k

- Including house equity our Net Worth has increased above £220k

Even though pension contracted a fair bit with the global crisis good to see this still moving forward

One of my old favourite graphs. Excluding Holiday Savings means we exclude money which is committed to being spent. So this is the money we have invested or put aside that I expect to keep,

Always good to see the YOY growth of all money. Amazing to think that it's not actually been that long - about 4 years since I started tracking.

Very happy to see the first payments for the kids included here.

They all have cash savings which are not expected to be added to an further. Now I'm investing £50 each into global index fund.

The oldest is about to turn 8 so that's at the very least a decade of compound growth and TIME in the market for my little angel.

No comments:

Post a Comment