I quickly scanned 20~ companies and decided to do a deep-dive on Unilever, ULVR.

Info:

A stock I don't own in a sector (personal goods) I do not own.

It's brands include Dove, Magnum, Lipton, Hellmans.

The largest company on the FTSE100 by Market Cap. About 1/10 the size of Apple.

Sounds like a very defensive company and quarterly dividends sounds aligned to that.

Share price 52-week high is £53.33 per share. 52-Low is recent £40.21. Currently available just under £41.27.

Dividend Record:

Over 20 years of consecutive dividend growth. Growing at over 5% per annum. Whist the Div Cover dropped below my threshold last year, it was above for the previous four.

Financials:

I don't really know what I'm doing in this area. But lots of reading over the years has led me to focus on a couple of core things.

- Are Earnings Per Share (EPS) consistently growing? YOY EPS growth 5+ year

- Grown in 4 of the last 5 years.

- Are they paying out too much on dividends? Payout Ratio <60%

- Was lowest in 2019 than for a long time, has in most prevoius years been jsut above 60%, which I wouldn't like. However, it does seem this is fairly normal for a defensive stock.

- Is the ratio of share price to earnings sufficiently low enough? PE ratio <18

- On the money, would prefer them to be cheaper, but 18.24 is within acceptable bounds.

- Is the Gross and Net Operating profit high enough? Gross 20%> Net 5%>

- ✅Gross average is above 40%, Net above 16%

Conclusion:

The scale of the company and the position they are in, coupled with the consistency of their dividend track record makes me feel this one is a fairly low risk decision to BUY.

~~~~~~~~~~~~~~~~~~~~~

So ULVR were added to my portfolio, bringing the total up to 5 decent companies.

5 shares were added for a cost including fees of £212.48, an average price per share of £42.50. A yield of 3.84%

This adds £8.15 expected annual dividends to my portfolio, taking the total annual expected dividends too £42.44.

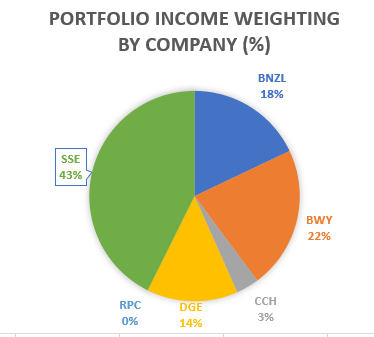

ULVR now represent 20% of my portfolio based on Value and 19% based on income.

I'll receive dividends on a quarterly basis, starting in June.

FYI

I use this website for financial date review; http://financials.morningstar.com/ratios/r.html?t=xlon:ulvr

And this one for the historical dividend date review: https://www.dividenddata.co.uk/dividend-history.py?epic=ULVR

No comments:

Post a Comment