Feb '20

|

|

Gross Income

|

£6,912.71

|

Total Tax and NI

|

£1,995.94

|

Total Variable Spending

|

£2,533.28

|

Total Fixed Spenging

|

£1,497.41

|

Total Short Debt Repayment

|

£0.00

|

Net Income pre Fixed Savings

|

£886.08

|

Savings Rate (%) pre Fixed

Savings

|

13%

|

Fixed Savings

|

£941.38

|

Net Monthly Cash

|

-£55.30

|

Cash Savings Rate (%) Post

Fixed Savings

|

-0.01

|

Commentary:

Variable spending slightly too high so need to keep an eye on that, especially with known increases for the monthly fixed savings due to start in March (Kids ISAs etc).

Income boosted by £85 in train compensation and company returns.

Tax and NI same as usual.

Variable spending of £2,533 was £282 over the average for the last 12 months (£2,251).

This seems mainly due to a number of bills landing and us spending about one big shop more than usual on groceries.

No cancel tax this month, or in March, so fixed spending down slightly.

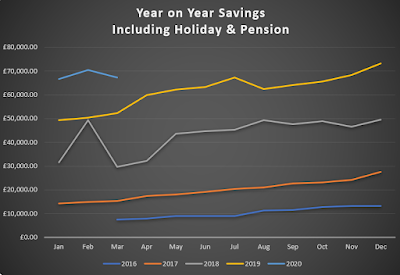

February Wealth Update

- £341.38 paid by me into my workplace pension.

- Value dropped a bit with the markets, currently £48.8k

- £100 added into my SIPP

- Value also dropped a bit with markets, currently £2.1k

- £500 paid into my workplace sharesaves, of which £300 is ring-fenced for holidays.

- Currently values;

- £1.9k in equity investments

- £5k emergency cash savings

- £9.5k in rolling accounts for holiday spending for 2020,21,22 & 23

No comments:

Post a Comment