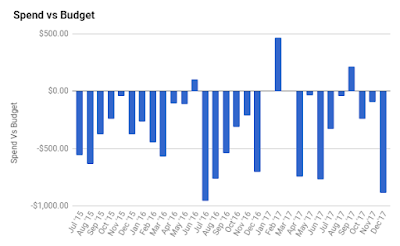

So, did we stick to the budget?

Nope. We spent £884.57 more than our budget!!!!!!!!!! Shocking.

If no, why not?

We spent a fortune on Christmas and days out seeing family and friends. We had a great time, don't regret a thing but now back to the more sensible business of being good with our money.

We also had a had a couple of big outgoings not related to Christmas including sons birthday party booking.

Did we earn more than we spent?

No. For only the second time in 2017 we spent more than we earnt. £571.27 more to be precise.

This really was an expensive month.

Any positives / milestones?

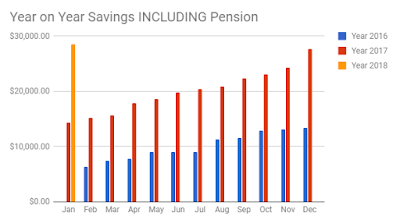

- Savings in shares (either directly or through work sharesave) increased beyond £3k for the first time.

- Cash savings also increased over the £3k threshold for the first time.

- Therefore also Shares + Cash savings increased over the £6k threshold.

Lessons / thoughts?

Christmas was expensive. I had almost 4 weeks off work with family so it all came to a head at the same time.

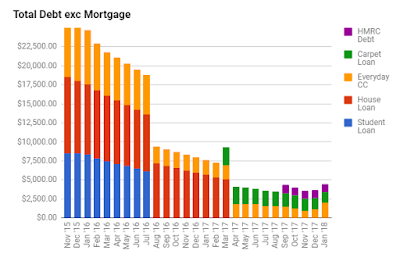

Effect on overall debt?

Christmas was expensive. I had almost 4 weeks off work with family so it all came to a head at the same time.

Effect on overall debt?

Student loan remains paid off :)

House loan remains paid off :)

Every day card balance is £1,983.58

0% Carpet loan balance is £1,386.58

HMRC debt - due 31/1/18 is £1,080.68

Wealth Accumulation

Summary:

Asset

|

Value

|

Increase

|

Pension Value

|

£22,302.01

|

£321.75

|

XO Shares Account

|

£67.06

|

£4.36

|

Company Dec '19 Sharesave

|

£1400.00

|

£100.00

|

Fidelity Global Index Tracker

|

£1,264.11

|

£118.58

|

Cash (Matched Betting Liquidity)Betfair

|

£1,939.32

|

£216.49

|

Cash (Emergency Savings)

|

£0

|

£0

|

Cash (Annual Bills)

|

£1068.57

|

£0.17

|

Company Dec '20 Sharesave

|

£200.00

|

£100

|

Trading212 Equities

| £230.44 | -£9.56 |

No comments:

Post a Comment