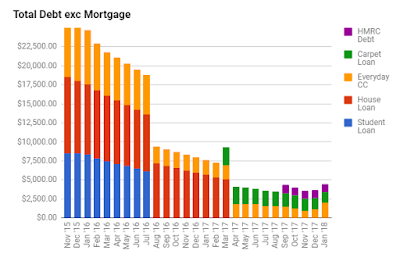

Quite frankly to feel like I am in a position to be able to consider which investment path I head down is delightful having come from £25k in debt and not really being able to see the end of the tunnel.

A couple of things are obvious...

- Purchase price of likely properties.

- Mortgage options and costs.

- Other associated costs when buying a mortgage.

In credit card debt, carpet loan and desire to have £2k in emergency cash fund = £6,300

For solicitor fees, mortgage fee, survey, stamp duty, letting fees = £6,750

Deposit to make up difference (£125k purchase - £93k mortgage) = £32,000

- Then how long will it take me to have that money available.

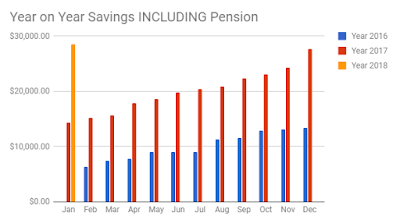

I've assumed that I'll continue getting bonuses at the current rate.

I predict I would have the savings to pay off my debt by Jan-2019

Have enough saved to cover all costs associated with the purchase by Mar-2019.

But then not have enough to cover the deposit until March-2021.

Conclusion

In three years so much can change. However, it's clear that by relying on saving up cash to purchase a property we're going to be waiting for many years.

So... is there another way? I've been loosely discussing the prospect of freeing up a slight % of equity in our house.

Our LTV is currently 72% by releasing £25k we could increase our LTV to 75%.

Reducing the deposit down to £7k would - according to me predictions allow us to afford to buy a property in Dec-2019.

Further, I am currenty saving £100 per month into global index fund and have an £8k car loan which I plan to pay off with my bonus in two months time.

If we instead kept the bonus, stopped paying into the global fund and then used that money to pay for the car loan instead we would - theoretically- have sufficient savings to purchase a property next March-2019.

The giant BUT here is if my current provider will allow me to borrow more - my wage hasn't gone up - and if so are there any penalties which would make it unwise.

Having said all of that, the idea that there is even a possibility that we could afford to purchase a buy-to-let next year is pretty damn exciting!!!!!!!!!!!

So next steps...

- Next post review numbers for how I think it should stack up annually.

- Run my financial plan again to make sure I'm not fooling myself with a missed calculation.

- Double check I am not being too optimistic on the purchase price or purchase fees.

- Wait until March when I will receive bonus and potential pay-rise. Factor this into financial plan.

- And only then discuss with by bank on the possibilities in release extra money.