I've chosen to narrow down this list by looking at the stocks with the:

- highest average dividend growth over 5 years

- highest current yield

- longest period of dividend growth

- I chose two here as there was little difference and one was quickly ruled out

~~~~~~~~~~~~~~~~

Stock #1 has the highest average dividend growth over the last 5 years. Bellway (BWY)

Why would I buy?

It ticks all my screening requirements, has a great average dividend growth over 5 years and the payout ratio remains particularly low. They've increased operating profit year on year for 5 years whilst increasing net assets. 0/8 brokers suggest a sell, 5 a buy.

What concerns or considerations do I have?

The dividend has been cut twice - in '08 and '09. Plus the more recent annual dividend was significantly lower than the previous 5 - pointing to the dividend growth wave slowing down.

Summary

The div was indeed cut, but at least it was maintained during a horrible time for companies in this sector. If indeed the dividend wave has been ridden it was still a double digit increase last year and with the current yield this company still meets my requirement of return on capital via dividends only within 18 years with a div growth as low as 4%.

~~~~~~~~~~~~~~~~~~~~~~~

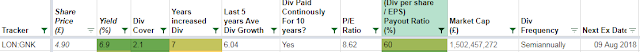

Stock #2 has the highest yield @ 6.9% = Greene King (GNK)

Why would I buy?

It ticks all v3 screen requirements and has a very high current yield with decent dividend growth. Although they've only had 7 years consecutive dividend increases the two cuts in '09 and '10 were both small reductions (13% and 4%) compared to most other cuts I have seen which when the decision is taken to cut quite a chunk (40%+) is removed.

What concerns or considerations do I have?

Whilst revenue has increased year on year for the past five years, operating profit, profit before tax and EPS have all reduced in at least one of the 5 years.

Reading the HL research view provides explanations for this. In a nutshell they are in an ever competitive market and are being driven down on price and up on investment which has resulted in the higher revenues but reductions in profits.

Summary

If the concerns about the competitive market were not there this would not be at the current yield.

The fluctuations in the profitability of the company need to be weighed up against the high yield.

~~~~~~~~~~~~~~~~~~~~~~

Why would I buy?

It ticks all v3 screen requirements and has a very high current yield with decent dividend growth. Although they've only had 7 years consecutive dividend increases the two cuts in '09 and '10 were both small reductions (13% and 4%) compared to most other cuts I have seen which when the decision is taken to cut quite a chunk (40%+) is removed.

What concerns or considerations do I have?

Whilst revenue has increased year on year for the past five years, operating profit, profit before tax and EPS have all reduced in at least one of the 5 years.

Reading the HL research view provides explanations for this. In a nutshell they are in an ever competitive market and are being driven down on price and up on investment which has resulted in the higher revenues but reductions in profits.

Summary

If the concerns about the competitive market were not there this would not be at the current yield.

The fluctuations in the profitability of the company need to be weighed up against the high yield.

~~~~~~~~~~~~~~~~~~~~~~

Stock #3 has longest unbroken years of increasing the dividend = Spectris (SXS)

Yield only 2.2%, ave growth over 5 years is 5%, which is outside of the timeframe (23-25 years instead of 18) for dividend return on capital I have been considering. Given this I won't be investigating any further for now.

Yield only 2.2%, ave growth over 5 years is 5%, which is outside of the timeframe (23-25 years instead of 18) for dividend return on capital I have been considering. Given this I won't be investigating any further for now.

~~~~~~~~~~~~~~~~~~~~~~

Stock #4 has the second longest continuous streak of raising dividends = RPC Group (RPC)

Why would I buy?

It ticks all the requires for my v3 stock screen and has 25 years of increasing dividends. Revenue, profits and net assets have all increased annually over the last 5 years, and 5/6 brokers recommend a buy, the other is a neutral.

What concerns or considerations do I have?

Yield at 3.6% is lower than the 4% target I had buy coupled with ave dividend growth of 18% over 5 years it easily fits within the return on capital via dividends only period.

*Update* However, I've just found out that the dividend history from DividendMax website is different to that on HL and the Telegraph. So then updating the dividend growth returns a an ave growth of 14%. However, this is based on one giant increase last year by 61% and the remaining 4 years grew at a rate of 3% which would bring it below my return threshold target.

~~~~~~~~~~~~~~~~~~~~~~~~~

Decision

I'm happy to invest in BWY & RPC.

Given the amount I've learnt and the updates to my stock screen, my initial purchase of SSE looks considerably more riskier than I initially envisaged. For that reason for this stock purchase I'm going to opt for the one which I deem less risky - RPC - I'm particularly impressed by the 20+ years of consecutive dividend increases.

However, I do like what I saw with BWY and expect this to be a contender in April.

Here's the purchase...

This adds £6.96 to my expected annual income, bringing it to a total of £22.36 expected in dividends each year.

Stock #4 has the second longest continuous streak of raising dividends = RPC Group (RPC)

It ticks all the requires for my v3 stock screen and has 25 years of increasing dividends. Revenue, profits and net assets have all increased annually over the last 5 years, and 5/6 brokers recommend a buy, the other is a neutral.

What concerns or considerations do I have?

Yield at 3.6% is lower than the 4% target I had buy coupled with ave dividend growth of 18% over 5 years it easily fits within the return on capital via dividends only period.

*Update* However, I've just found out that the dividend history from DividendMax website is different to that on HL and the Telegraph. So then updating the dividend growth returns a an ave growth of 14%. However, this is based on one giant increase last year by 61% and the remaining 4 years grew at a rate of 3% which would bring it below my return threshold target.

~~~~~~~~~~~~~~~~~~~~~~~~~

Decision

I'm happy to invest in BWY & RPC.

Given the amount I've learnt and the updates to my stock screen, my initial purchase of SSE looks considerably more riskier than I initially envisaged. For that reason for this stock purchase I'm going to opt for the one which I deem less risky - RPC - I'm particularly impressed by the 20+ years of consecutive dividend increases.

However, I do like what I saw with BWY and expect this to be a contender in April.

Here's the purchase...

This adds £6.96 to my expected annual income, bringing it to a total of £22.36 expected in dividends each year.

Good luck with your purchases.

ReplyDeleteI see today that Bellway have announced a 28% increase to their interim dividend - maybe check to see when ex-dividend date is so you can get your purchase in before that date, if you still fancy them.