So, did we stick to the budget?

Nope. £742.08 over. Excluding work expenses - which will be repaid.

Did we earn more than we spent?

Nope. Spent £300.04 more than we earnt. Excluding expenses.

Any positives?

Total debt excluding mortgage dropped below £4k for the first time. Which means in 18 months we've paid off nearly £22k of debt.

Also, not particularly positive, but explanations.

Paid final tax repayment of £472. Excluding for this one-off we would have earnt more than we spent.

We also had to pay £200 for childcare. However, this is a deposit which we'll get back in 18 months.

On top of this, this is always a busy time of the year for us. With all four of our birthdays falling between February and May as well as our wedding anniversary.

Lessons / thoughts?

It's been hard to get a clear picture with my work expenses sandwiched in the middle. I've now set up a separate credit card to deal with this and make it cleaner going forward.

We still have very little 'contingency cash' for when unexpected issues crop up. This is our priority now.

Almost every month we've over spent. Often because each month has a big one-off unexpected payment in it. Perhaps it's due to poor planning on my part or poor budgeting. Will change nothing for now but will consider this over the coming months and perhaps do some digging into previous months to try and see if there is a better way to capture this.

Effect on overall debt?

It's been hard to get a clear picture with my work expenses sandwiched in the middle. I've now set up a separate credit card to deal with this and make it cleaner going forward.

We still have very little 'contingency cash' for when unexpected issues crop up. This is our priority now.

Almost every month we've over spent. Often because each month has a big one-off unexpected payment in it. Perhaps it's due to poor planning on my part or poor budgeting. Will change nothing for now but will consider this over the coming months and perhaps do some digging into previous months to try and see if there is a better way to capture this.

Effect on overall debt?

Student loan remains paid off :)

House loan remains paid off :)

Wedding card balance stands @ £1,803.52.

0% Carpet loan balance is £2,178.98.

Total Debt Exc Mortgage = £3,982.50

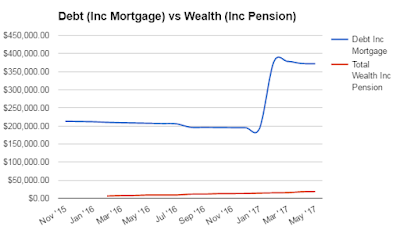

*this isn't that much of a useful graph anymore as it includes expenses and the large spike in Mar'17 was paying off debt from our bonus, so it's a positive really not a negative. However, I've not got a better graph yet to illustrate our spending. One to think on.

*This surprises me. What I realised is that we were paying off credit card from overspending in recent months so it's all a bit out of kilter. I need to work hard to align everything so that in circumstances like the above months when we earn more than spend - that we actually have something left over to save.

*not long to go now.

Wealth Accumulation

Summary:

| Asset |

Value

|

Increase

|

| Pension Value |

£17,539.21

| £505.82 |

| XO Shares Account |

£58.10

|

£5.21

|

| Company Sharesave. |

£600

|

£100

|

| Fidelity Global Index Tracker |

£398.46

|

£94.32

|

| Total |

£18,595.77

|

£705.35

|

Wealth excluding pension rising steadily now that I've set up direct debits into the Shares ISA and for the company Sharesave.

*this shows how little % and in value terms we have as available cash saved. However, is nice to see the pot increasing even if it cant be accessed for 25 years!

*The graph I pay most attention too I think. Before I was 'paying myself first' through direct debit this wasn't really changing month on month. Now we're seeing incremental gains each month and this month crossed the £1k barrier. Each milestone matters!

~~~~~~~~~~~~~~~~~~~~~~~~

Net Worth

Savings Assets = £18,595.77

Debt (exc mortgage) = £3,982.50

House Value = £500,000

Mortgage = £367,973.88

Net worth = £146,639.39

*Absolutely miles off!

*my second most looked at graph. Only a couple of grand in it now. Will be a big fat smile on my face when these lines intersect.

No comments:

Post a Comment