So, did we stick to the budget?

Christmas. We spent roughly £500 on eating out as a family and £200 on travelling to see family.

Any positives?

Spending is over now.

Debt has dropped below £8k.

Lessons / thoughts?

Should budget for this for next year.

Expectations for next month?

Should budget for this for next year.

Expectations for next month?

Try and have a really lean month. However, potentially we'll be moving into the new house so might come up with unexpected costs then.

Effect on overall finances?

S Student loan – Does not exist anymore :)

· House loan – £298 was paid off direct debit. Total remaining now is £5,653

· Credit Card - £45.46 was paid off. Total remaining now is £1,975.37

Total Debt = £7,628.37

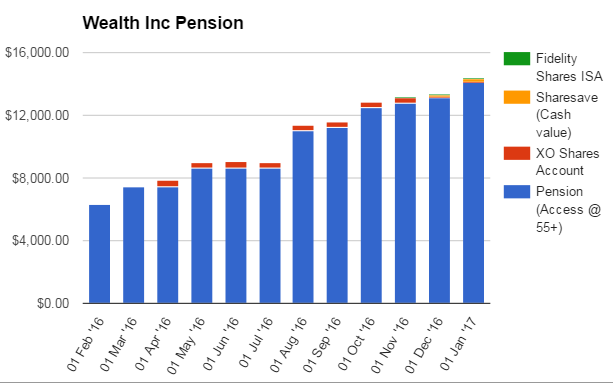

Wealth Accumulation

Summary:

Problem setting up the monthly share save scheme has led to no further payments being made.

I sold my personal PPBF shares as now I am in the work sharesave scheme. £60 remains as cash in the account to prevent closure fee of £60.

I sold my personal PPBF shares as now I am in the work sharesave scheme. £60 remains as cash in the account to prevent closure fee of £60.

No comments:

Post a Comment