So, did we stick to the budget?

Nope. £95 over budget.

If no, why not?

Started buying Christmas presents. Spent a little more on petrol, on family treats and on my travelling to work and it all added up to more spent than planned.

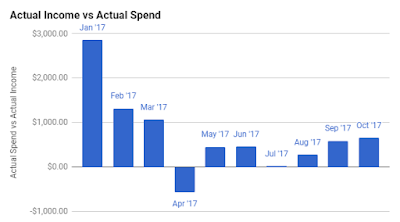

Did we earn more than we spent?

Yes. For the 7th month in a row. This time £437.36 more. Largely thanks to a £221 cheque from British Airways compensating me for many lost hours a few months ago.

Any positives / milestones?

- Earnt more than spent for 7th month in a row.

- Total wealth excluding pension jumped above the £5k barrier to £5,665.

- This time last year this figure was just £210!

- Total wealth including pension jumped above the £25k barrier to £27,645

- This time last year this figure was just £13,338!

- Net worth jumped above the £160k barrier to £160,089

- This time last year this figure was just £37,798!

Lessons / thoughts?

Should really be including Christmas spending in the budget. Probably for 2018 should include within expected bills for the year.

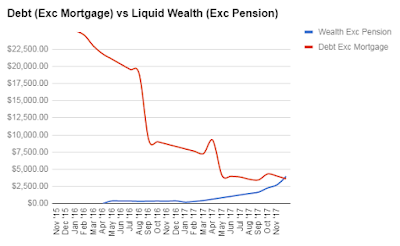

Effect on overall debt?

Should really be including Christmas spending in the budget. Probably for 2018 should include within expected bills for the year.

Effect on overall debt?

Student loan remains paid off :)

House loan remains paid off :)

Every day card balance is £1116.88

0% Carpet loan balance is £1,485.63

HMRC debt - due 31/1/18 is £1,080.68

Wealth Accumulation

Summary:

Asset

|

Value

|

Increase

|

Pension Value

|

£21,980.26

|

£1,681.76

|

XO Shares Account

|

£62.70

|

-£2.42

|

Company Dec '19 Sharesave

|

£1300.00

|

£100.00

|

Fidelity Global Index Tracker

|

£1,145.33

|

£100.31

|

Cash (Matched Betting Liquidity)Betfair

|

£1,722.83

|

£181.36

|

Cash (Emergency Savings)

|

£0

|

£0

|

Cash (Annual Bills)

|

£952.39

|

£952.39

|

Company Dec '20 Sharesave

|

£100.00

|

NE

|

Trading212 Equities

| £240.00 | NE |