We now live in a house we feel we could comfortably live in for the foreseeable, and have moved from debt repayment to wealth creation.

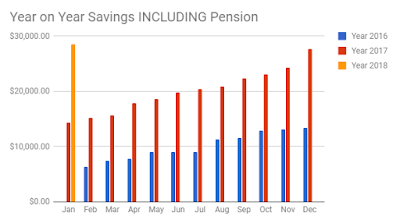

- We increased our savings exc pension from £310 to £6,247.51!

- Total savings inc pension has increased from £14,391 to £28,549.52

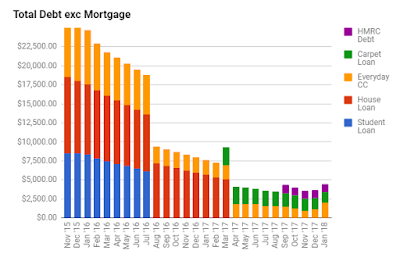

- We've paid off the entire house loan (was £5,653).

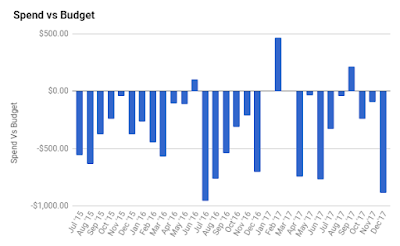

- We've spent less than we've earnt in 10 of the 12 months in 2017

- We stuck to budget in 2 of the 12 months, and were within £50 on 3 further occasions.

- Our net worth, which is really a wrap up of all of the above, has increased from £147,900 to £160,800.01

Having said all of that when I look back at my goals for 2017 it doesn't look as rosy. I guess some most of this can be put down to changing priorities throughout the year.

Financial:

- Pay off the remaining £7,628 of debt.

- Failed. Still have CC debt remaining.

- Increase wealth excluding Pension to £3000

- Completed.

- Overpay on the mortgage by £600. Equivalent to £50 per month.

- Failed. Didn't put a penny towards this.

To do:

- Get a will for the family.

- Completed.

- Complete one item from my bucket list

- Completed. Played a complete season of Saturday 11-a-side football before I turned 30.

Physical:

- Get weight to below 14st

- Failed. Nearly 15st now.

- Run 13.1k without stopping (half marathon distance)

- Failed.

~~~~~~~~~~~~~~~~~~~~~~~

What do we know is going to happen in 2018...

- We're going to have our third child.

- We're going to need to buy a new 7 seat car

- I expect to receive a bonus in Q1.

- HMRC debt needs to be re-paid. So our Savings Exc Pension will drop by £1k but our debt will drop in parallel.

What are the aims for 2018?

Financial

Financial

- Cash savings to reach £3,398 or in other words one months salary

- Savings exc pension to reach £10k

- HMRC debt to be re-paid in January

- Carpet debt to be repaid in 2018

- Overpay on the mortgage by £600 or equivalent to £50 per month.

- Some sort of physical piece here. To be confirmed shortly.

- Tick off one item from my bucket list.

- Some charitable giving.