The highs (financially)

- Total debt has decreased over £10k, now standing at £361k

- Debt Exc Mortgage has decreased over £3k, now standing at £5.6k

- Total savings have increased by £18k, now standing at £46k

- Pension increased by £13.8k, now standing at £36k

- Net worth has increase by £35.6k, now standing at £192k

The misses (financially)

- The purchase of the car and the loan this required meant that we didn't finish 2018 with as much cash saved up as I'd hoped. Our emergency funds currently stand at £2k.

What does 2019 hold in store for us?

- At the moment I am contemplating jumping back into a plan to get us in a position to buy-to-let. But I know that this is a feeling/desire I've had for many years - since I was a child - and so will give it time to see if it looks like something we truly will put our all into.

- I need to keep up the matched betting motivation as this has the opportunity to bring in good additional income.

- This is the last year that we're required to save up additional money for a family holiday - from 2020 on-wards the savings we've been making into my work sharesave will give us a minimum of £3,600 per year to spend on a holiday on a rolling basis. So priority is to make sure we a) have a great time and give the kids some awesome memories but also b) dont get into additional because of it

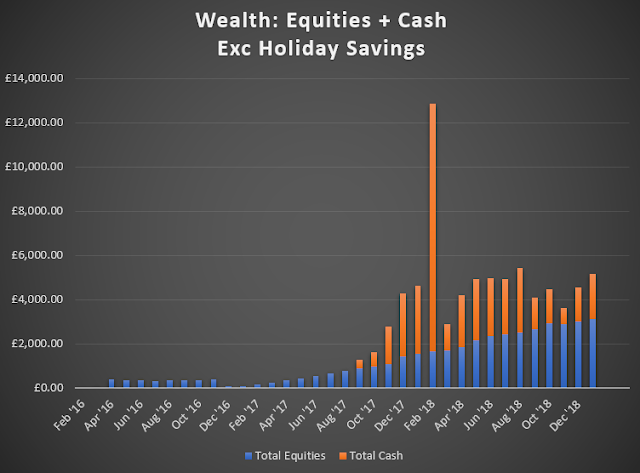

Finally, some graphs to top off the year.

Can see the affect of lifestyle inflation over the last 3 years. The big jump from 2016 > 2017/18 is due to the larger mortgage payments in part, but still one to watch over 2019.

Shame about the addition of the car loan really, but getting there.

A steady upwards curve for the equities, cash has been a bit all over the place. The large spike was when we had the loan sitting in our account but before we actually purchased the car, so that's not really relevant. Looking for an increase in the solid gains here in 2019.

I was happy back in August when including our Holiday Savings we finally had more money saved than we owed (exc mortage and pensions) but given we've committed to spending that I've recently excluded that so we're chasing the debt tail again. SO close to tipping this over and sailing on up in 2019 though.

Look where we were in March of 2016 - when I started focusing on managing our money properly.

No comments:

Post a Comment