During the month our oven, dishwasher and washing machine all broke down!

Summary:

Other than almost every appliance we own breaking we also bought a 30th birthday experience for the brother-in-law and a 60th birthday present for the mother-in-law, along with our own daughters 6th birthday present AND pre-paying for a photo shoot for when baby 3 comes along this month AND paying for spending money for our couple of nights away with friends.

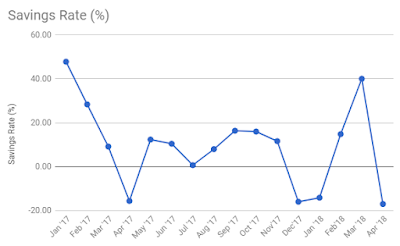

All in all it was an expensive month and we ended up spending more than I earnt and having a savings rate of -17% :(

Milestones:

- Our carpet loan dropped below £1k.

- Pension value surpassed £33k

- Equities, Cash + Pension surpassed £40k

- Current Assets minus Current Liabs difference is below -£1k.

Numbers:

Graphs:

No comments:

Post a Comment