So, did we stick to the budget?

No. We spent £43.29 over budget.

If no, why not?

Main out-goings were a £200 new dining table the wife bought - not very frugal but she's been waiting years and it's worth alot more.

£50 for kids school milk for the next school year.

£101 accidentally paid for whole family dinner - mix up with the granddad :)

Did we earn more than we spent?

Yes. We earnt £283.09 more than we spent.

Any positives / milestones?

- 4th month in a row we have earnt more than spent.

- Spend over budget was less than £50.

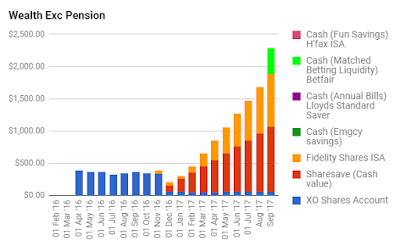

- Pension savings topped £20k

- Sharesave value reached £1k

- Total savings excluding pension topped £2k

- Net worth increased by over £1k

Lessons / thoughts?

So close this month to being on budget. Making a concerted effort for September with the wife.

Priority is paying down the everyday credit card which will soon run out of 0% interest.

Using the Betfair Matched Betting value as our emergency fund blanket currently.

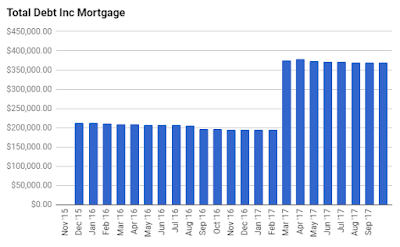

Effect on overall debt?

So close this month to being on budget. Making a concerted effort for September with the wife.

Priority is paying down the everyday credit card which will soon run out of 0% interest.

Using the Betfair Matched Betting value as our emergency fund blanket currently.

Effect on overall debt?

Student loan remains paid off :)

House loan remains paid off :)

Every day card balance is £1,465.21

0% Carpet loan balance is £1,782.78

HMRC debt - due 31/1/18 is £1,080.68

Wealth Accumulation

Summary:

| Asset |

Value

|

Increase

|

| Pension Value |

£20,489.18

| £252.81 |

| XO Shares Account |

£63.49

|

£0

|

| Company Sharesave. |

£1000

|

£100

|

| Fidelity Global Index Tracker |

£819.59

|

£104.89

|

| Cash (Matched Betting Liquidity)Betfair |

£405.36

|

NE

|

| Total |

£22,372.26

|

£1,444.47

|

~~~~~~~~~~~~~~~~~~~~~~~~

Net Worth

£152,413.12

An increase of £1,148.89 since last month.

No comments:

Post a Comment