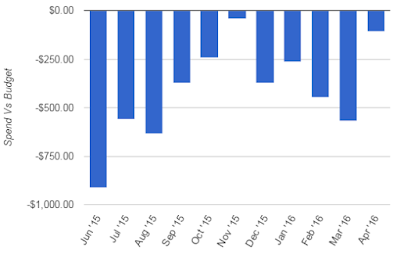

So, did we stick to the budget?

If not, why not?

Grocery shopping. It was £129 over budget. Disappointing as this is the largest overspend on groceries in the entire 11 months I have been tracking. Without this over spend we would have been on track for the first time.

Any positives?

Variable spending was within budget for the first time. Quite often recently this has been significantly over. I cut back completely on work lunches, but we were still able to spend money on treats and home improvements. However, this is mainly due to no bills or large expenses.

Lessons / thoughts?

Spreading the payment of bills over 12 months (by saving up) is starting to even out the spending. Will continue to not spend money on work lunches, that made a big (£100~) difference.

£0 paid into the France or Emergency fund.

Expectations for next month?

1 major bill which I had overlooked due - £450. This is my sons first nursery bill. I pay for my daughters through childcare vouchers taken prior to tax, and will do the same for this after this period, which ends in August. I expect to wipe out all of our savings to pay for this so as not disrupt the monthly spend calculations.

Effect on overall finances?

S Student loan – £336 was paid off direct from payslip. Total remaining now is £6,796

· House loan – £298 was paid off direct debit. Total remaining now is £8,037

· Credit Card - £125.58 was paid off. Total remaining now is £5,455,75

Total Debt = £20,288

~~~~~~~~~~~~~~~~~~~~~~~~

Savings

Account to pay for bills.

- £62 added this month, total now is £186

Emergency savings.

- Target is £2629.29.

- £0 added this month.

- Current total is £219.84

Savings for France 2017 family holiday.

- £0 added this month

- Total now is £56

Shares

- Current value is £367.18 (decrease of £19.22 since last month)

Total accessible savings = £829.02 (£186 + £219.84 + £56 + £367.18)

Pension

Pension

- Current value is £8,639.07 (increase of £1,175.89 since last month)

No comments:

Post a Comment