Spending

Fixed spending down because of a lack of Council Tax, variable spending up because of replacement car tyres following an MOT.

Overall, happy with the consistency though and recording our 6th straight month of spending less than we earnt.

Spending levels are in line with previous years so far.

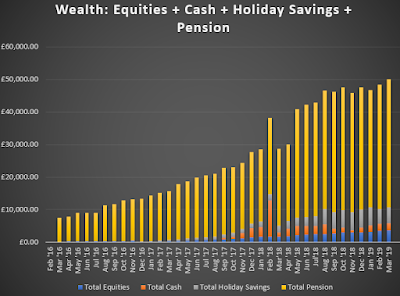

Total wealth topped £50k for the first time.

Difference between what we owe (exc Mortgage) and our savings (exc Pension and exc our holiday savings) increased very slightly again. Expecting to see a much more significant change in this next month.

Finally, it's always good to see how far we have come in terms of our savings including pension in the last few short years.

And then very sobering to see how much we actually owe compared to this...

I was £28k in debt excluding mortgage. I have used this blog to track my progress of paying that down and now I am using it support my dividend investing strategy for wealth creation.

Monday, 18 March 2019

Wednesday, 27 February 2019

#98 January Summary

Spending

- Tax the same as usual, £2,100~

- Variable spending lower than the previous 3 months at £1,700~

- Fixed spending stayed fairly static at £2k~

- for the first time we have more money saved (exc pension and money put aside for holidays) than we have debts (excluding mortgage). Really happy with this.

Subscribe to:

Posts (Atom)